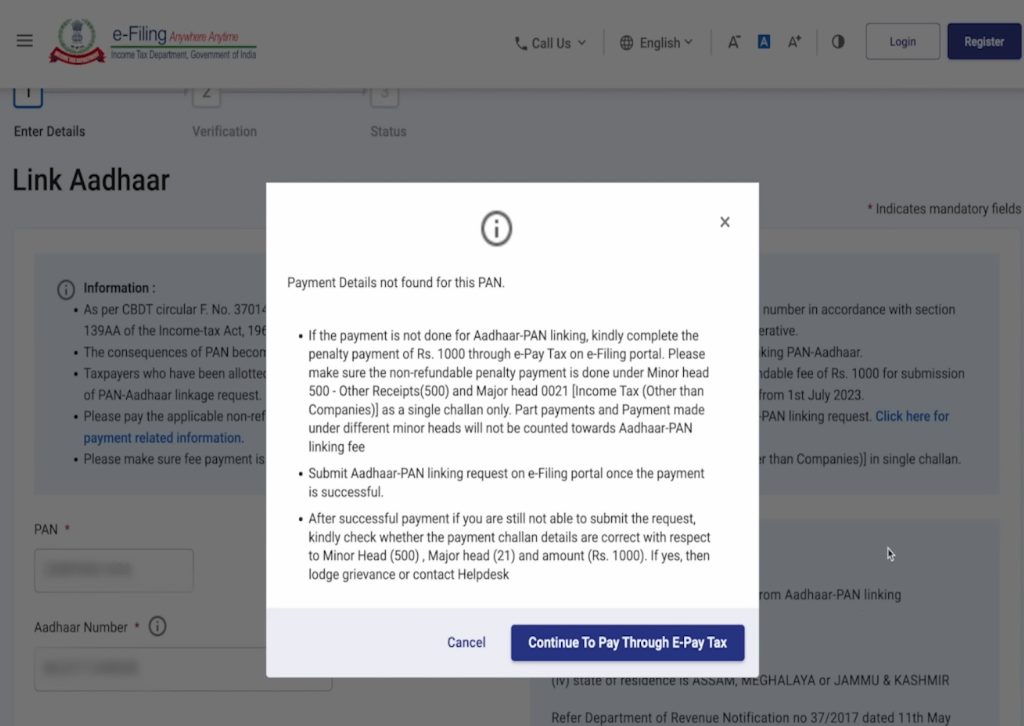

PAN Aadhaar Link :- All the PAN card holders who have not yet linked their PAN card with Aadhaar card should link it as soon as possible. The last date for linking PAN card with Aadhaar has been kept as 30 July 2023. The complete process to link PAN card is given below on the space. ₹ 1000 is being charged for linking PAN card with Aadhaar. Candidate should link his Aadhaar only after making the payment. All the information related to payment is given below on this page. Check the article given below and link your Aadhaar.

| Department Name | Income Tax Department Government of India |

| Article Name | PAN Link To Aadhaar |

| Objective | Help in the financial department, filing taxes, as an identity card |

| Article Category | government scheme |

| Last Date | 30 June 2023 |

| Fee | Rs. 1000 /- |

| Official Website | https://www.incometax.gov.in/iec/foportal/ |

Disadvantages of not linking PAN Aadhaar:

- If you have not linked your PAN card with your Aadhaar card before the deadline set by the government, then you may have to bear the following losses-

- Will not be able to file an income tax return

- PAN may be invalid

- Will not be able to do financial transactions of high value

- There may be a delay in the process of a tax refund

What are the benefits of the Aadhaar Se PAN Link?

Following are the benefits of linking Aadhaar to PAN –

- To avoid fraud, the government has made it mandatory to link a PAN card with Aadhaar.

- If more people pay taxes, the government will save more money to run more schemes for the benefit of the common person.

- Many people hide their income by making more than one PAN card, and now, with the link, they cannot hide their income and pay taxes.

- With Link Aadhaar To PAN, the government will have information about everyone’s accounts, which will help prevent tax evasion.

पैन आधार लिंक शुल्क :-

पैन और आधार को लिंक करने का शुल्क 1000 रुपये है। जो व्यक्ति अपने पैन और अपने आधार को अभी तक लिंक नहीं किया हैं तो जल्द लिंक करें। सभी को अब 1000 रुपये का अनिवार्य शुल्क देना होगा। यह प्रक्रिया अधिकृत ई-फाइलिंग वेब पोर्टल के माध्यम से की जाएगी। इस शुल्क का भुगतान करने के बाद, व्यक्ति लिंकिंग अनुरोध सबमिट करने के लिए आगे बढ़ सकते हैं।

पैन आधार लिंक भुगतान कैसे करें ?

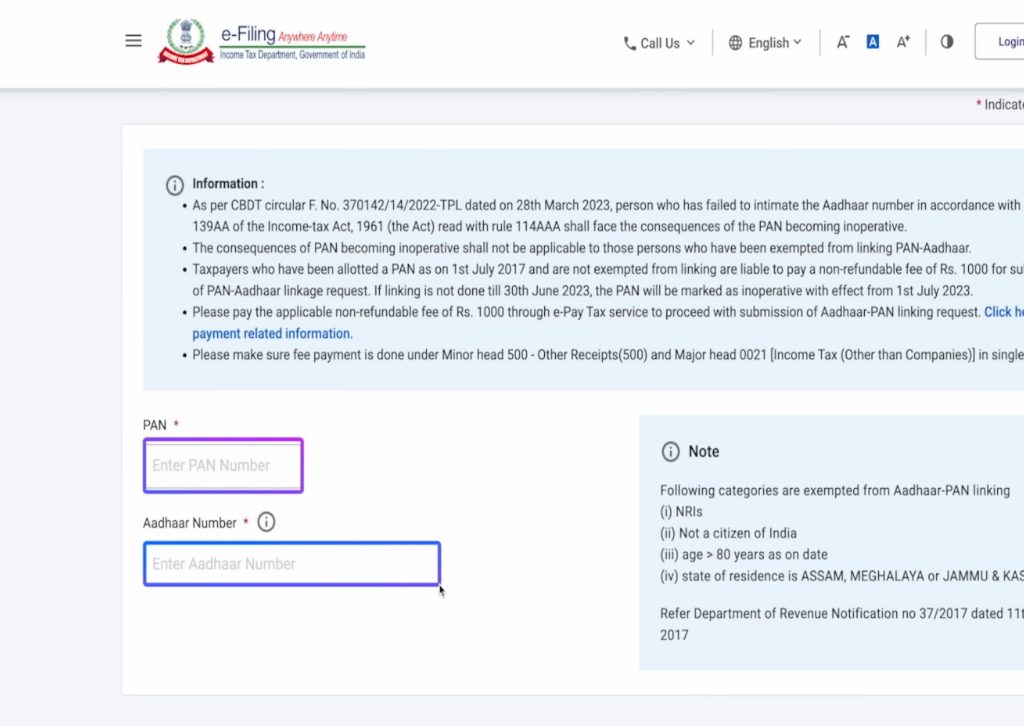

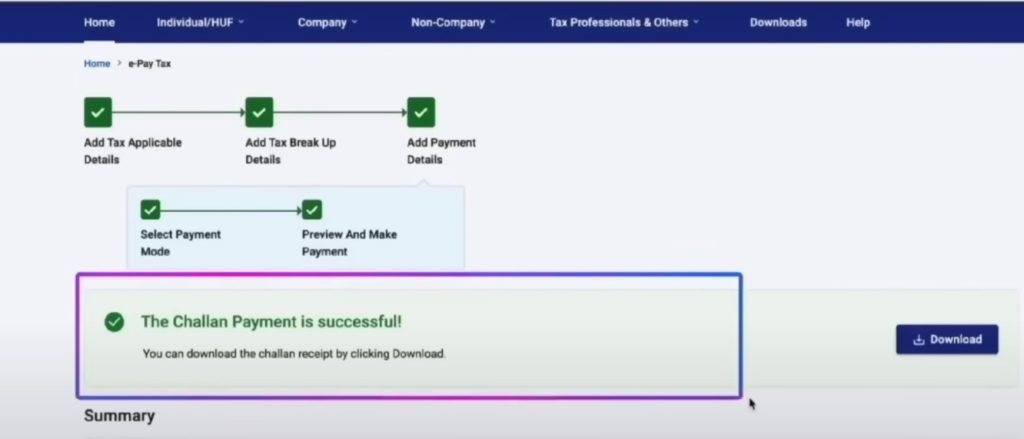

1000 रुपये का भुगतान करने के लिए, निचे दिए गए स्टेप्स को फॉलो करें –

- अधिकृत ई-फाइलिंग पोर्टल पर जाएं और “लिंक आधार” चुनें।

- अपना पैन नंबर और आधार नंबर दर्ज करें और जारी रखें।

- पैन/टैन और मोबाइल नंबर दर्ज करें और ओटीपी को मान्य करें।

- मूल्यांकन वर्ष चुनें और भुगतान का प्रकार (अन्य) चुनें।

- इसके बाद चालान जनरेट हो जाएगा.

- भुगतान मोड का चयन करें, और बैंक की वेबसाइट के माध्यम से भुगतान करें।

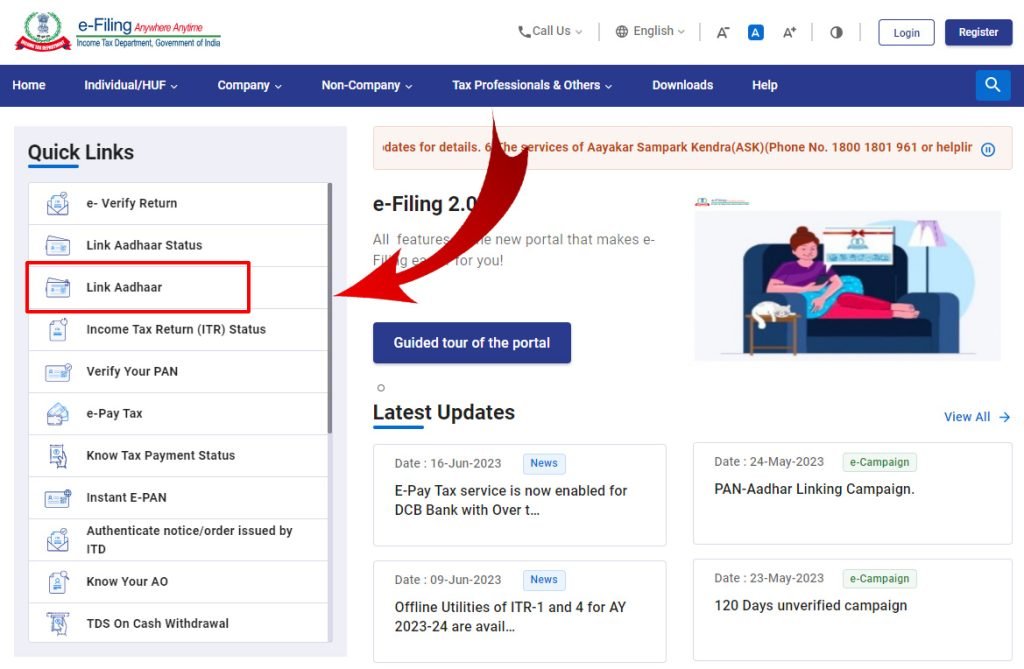

How to Link Aadhaar with PAN Card Online :-

How to link PAN card with Aadhaar card – Indian citizens wishing to link PAN card with Aadhaar card can link Aadhaar card with PAN card online by visiting the official website of the Income Tax Department and following the method given below.

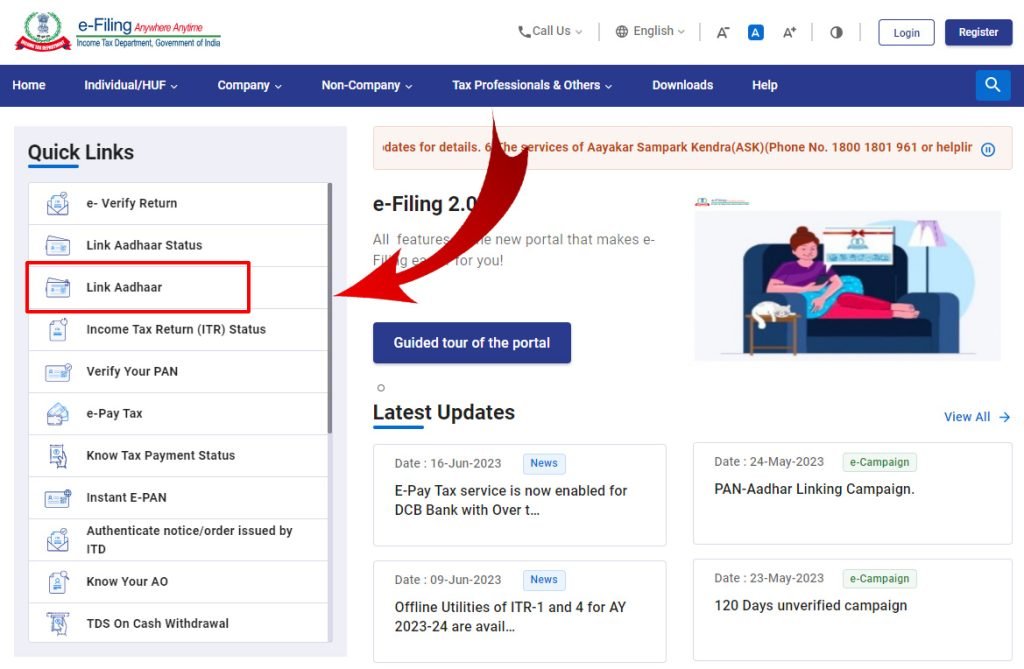

- First of all go to the official website of Income Tax Department. www.incometax.gov.in/iec/foportal/

- After that click on “Link Aadhar” in the quick link.

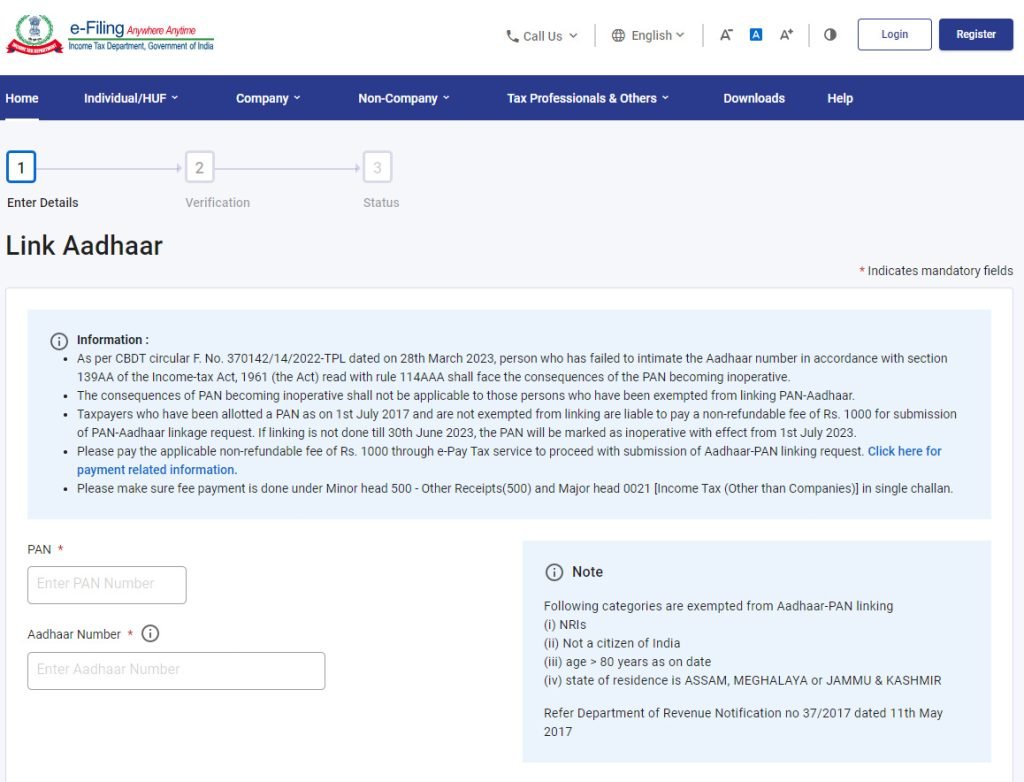

- After that enter your PAN card number and Aadhaar card number.

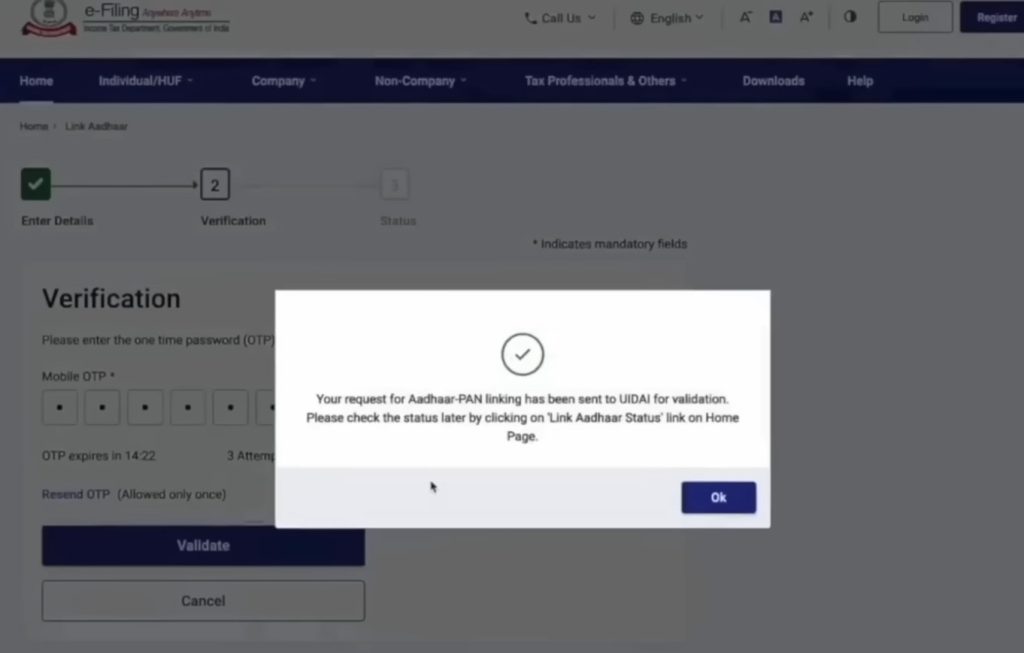

- After that click on the validate button.

- Now your Aadhaar card is linked with PAN card.

| Pan Link to Aadhar | Click Here |

| Check Pan Link Status | Click Here |

| Join Telegram / WhatsApp | Click Here |

| Official Website | Click Here |

FAQs

1000 रुपये का भुगतान करने के लिए, निचे दिए गए स्टेप्स को फॉलो करें –

First of all go to the official website of Income Tax Department. www.incometax.gov.in/iec/foportal/

30 June 2023